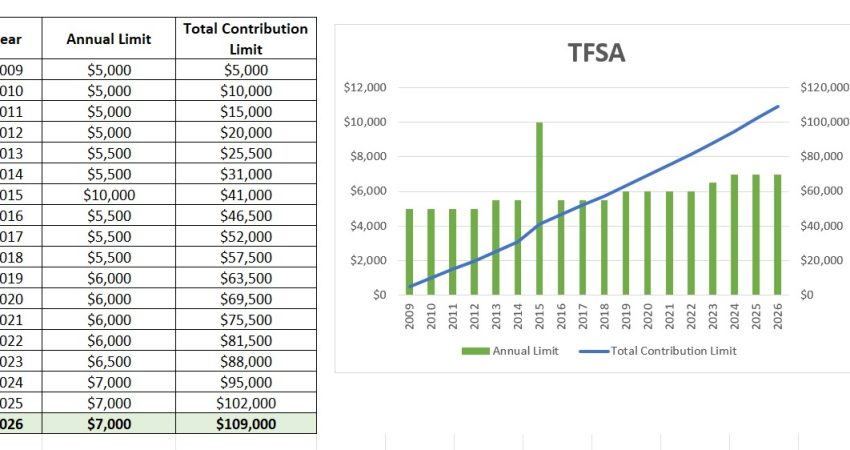

Tax Free Saving Account (TFSA) Updates for 2026 Canadians can earn tax-free investment returns using the plan referred to as the Tax-Free Savings Account (TFSA). Often I am asked, “should I contribute to an RRSP or a TFSA”. The two plans are very different. You get a tax deduction for contributions to an RRSP but […]

![]()