Are You in the Retirement Risk Zone?

Are you in the Retirement Risk Zone? The Retirement Risk Zone is the five to 10 years just before and after your retirement date. It’s the critical time when short-term losses can have negative long-term effects since there’s little time left for investments to recover.

As a CFP for over 20 years, I meet many individuals, families and business owners and what I find most common is that they don’t have a written financial plan. The most common goal that they want is an assessment of their current Retirement Income Plan to determine if it’s on track and if it’s not what needs to be changed. That is the focus of my company, Advantage Wealth Planning.

Common Questions

- Am I saving enough for retirement?

- When can I retire?

- How long will my money last?

- When to convert RRSPs to RRIFs and how quickly should RRIFs be drawn down?

- Should we buy an annuity to fund retirement?

- What are my Canada Pension Plan benefits? When is it best to start CPP?

- What are my Old Age Security options and when is it best to start?

- How do I setup a proper investment portfolio for my risk tolerance?

- Am I invested in the proper products?

- Will my investments last my lifetime?

- Are my investments suitable for my risk tolerance?

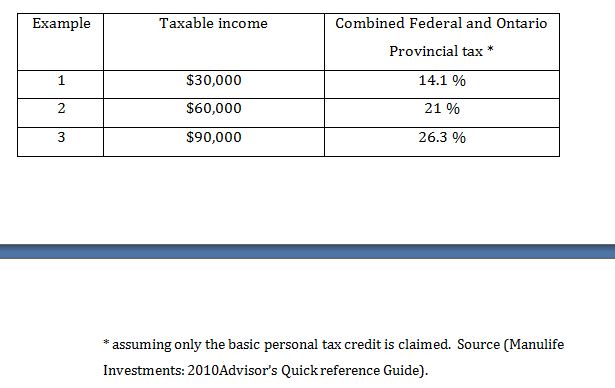

- How is my income taxed?

The list is virtually endless!

Financial Planning Service Offered

Advantage Wealth Planning offered two choices of Financial Planning solutions for clients until December 31, 2022. The Fee-for-Service Financial Plan is currently unavailable.

Advantage Wealth Planning proudly offers a Full-Service Financial Plan. The plan includes all six-steps from goal setting to implementation and monitoring in a written format with recommendations. Once the asset transfer is complete, the initial financial plan is completed at no additional cost. Subsequent financial plan updates, at no additional cost, are held annually or more often when major financial decisions are being considered. The minimum asset level for new clients is $150K. Investment management is by a third-party investment manager (that we have worked with for over 15 years), using pooled-funds, ETFs and individual securities. The investment manager and financial planner compensation are bundled into one transparent fee. Larger accounts are eligible to receive reduced fees and non-registered account fees may also be tax-deductible.

![]()

Latest Articles

Sid the Kid has $20M DI Policy

Sid the Kid has $20M Disability DI Policy One of the greatest hockey players is Sidney Crosby. While he has an obvious knack for putting the puck in the net, he is also a hard working forward who doesn’t hold anything back in the corners. Unfortuneately other less skilled player know this and it seems, in my […]

![]()

TFSA versus RRSP

TFSA versus RRSP The Tax Free Savings Account, TFSA, was introduced in 2009. The current contribution limit for both 2009 and 2010 is $5,000. If you don’t use it, you don’t lose it i.e. the limits are cumulative. Therefore, if you are age 18 or over in 2009, you now have $10,000 of TFSA room. […]

![]()

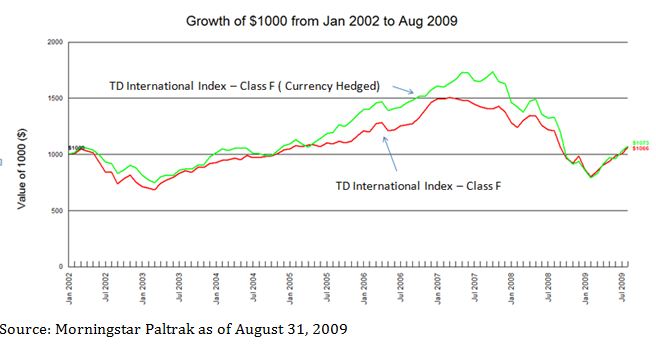

To Hedge or Not to Hedge…that is the question!

To Hedge or Not to Hedge…that is the question! In a recent publication in the Globe and Mail, Scotia Capital’s portfolio strategist Vincent Delisle stated that Canada represents 3.7% of the MSCI World Index (source: Globe and Mail Tuesday, September 8, 2009 02:10 PM, “Buy Canada, says Scotia”). While Canada is undoubtedly a great place […]

![]()

Time to Look at the Big Picture

Time to Look at the Big Picture While markets have rallied off their March 2009 lows, investors face uncertainty when investing solely in equity markets especially when it comes to their retirement portfolios. This article addresses the issue of stress testing your retirement income plan. I’ve written about this numerous times but it bears repeating […]

![]()

Secular Bear and Bull Markets

Secular Bear and Bull Markets One thing I do is spend time researching the history of the markets. While it does not predict the future, there are some interesting observations that you may be unaware of which could make a significant impact on how you view the markets and how you invest going forward. Over […]

![]()